Giving to St Anne's

If you would like to give of your time or your talents to support the work of St Anne’s, please contact a member of the clergy who will share the church’s vision, discuss your gifts and passions, and prayerfully consider how you can be involved.

Click here to read our 2024 Stewardship booklet

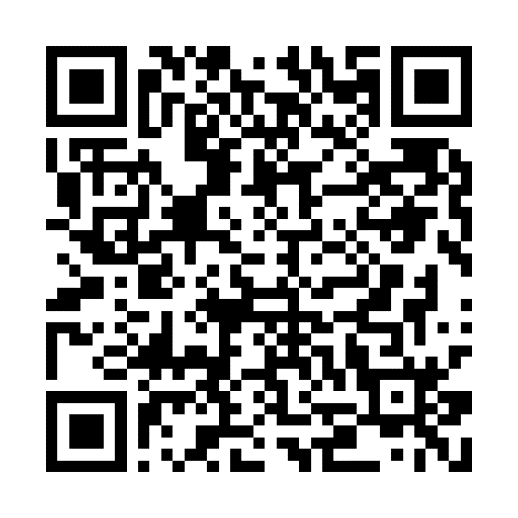

Donate to St Anne’s Church by scanning the QR code

The preferred way for the church to receive regular donations is through a standing order that you set up directly with your bank to pay in to the Church’s account with Royal Bank of Scotland. Many people can do this online, but however you set it up, you will need the following information about the church’s account:

Co-operative Bank

Account name: St Annes PCC

Sort code: 08-92-99

Account number: 67408713

You can include what you wish in any reference requested, but it helps us if you include your name, especially if that is not clear from the name of your account.

Click here to go to our online giving page.

Give by bank transfer

We are thankful for any gift given to St Anne’s Church. This can be done through a bank transfer, either with online banking or through calling your bank. Donations can still be made in church by cheque or by cash.

Co-operative Bank

Account name: St Annes PCC

Sort code: 08-92-99

Account number: 67408713

Giving in other ways

There are many other ways in which you can contribute financially to support the life and ministry of St Anne’s. Here is some more information about some of them:

1. Contactless giving

We now have a card reader avaiable at the back of church at most services where you can give up to £100 contactless. Alternatively to give any amount you can insert your card into the machine.

2. Payroll giving

Some employers operate a payroll giving scheme. This allows money to be donated to a charity such as St Anne’s church without paying tax on it.

More information is available on the Government’s website www.gov.uk/payroll-giving.

The scheme is an alternative to using Gift Aid and may have some advantages for higher rate tax payers.

3. Legacy funding

A gift in your will can be an expression of your gratitude and thanksgiving towards God, and can help to support the ministry of St Anne’s church into the future.

Since needs change over the years, we encourage those who wish to leave a gift in their will for the general purposes of the parish, rather than for a restricted purpose. The PCC will discuss with executors the most appropriate use of the gift in the light of current projects and the donor’s known areas of interest in the church.

A suggested form of words to use in your will is as follows:

“I give ___% of my residuary estate OR the sum of £ (pounds only) free of all taxes to the Parochial Church Council of the parish of St Anne’s, Shevington, Standish Lower Ground and Crooke, in the Diocese of Blackburn for its general purposes, and I declare that the receipt of an officer of the Parochial Church Council shall be a sufficient discharge to my executors and trustees.”

Gift Aid

If you are a tax-payer, it is a great benefit to the church if you can give tax-efficiently (we can claim back 25p for every £1 you donate). Download a Gift Aid form here.

More information about Gift Aid is available on https://www.gov.uk/donating-to-charity/gift-aid . Your donations will qualify for Gift Aid as long as they’re not more than four times what you have paid in tax in that tax year (6 April to 5 April).

A newly completed form may be applied to donations up to the last four years, if that is what you want and you let us know when you submit the form. You only need to fill in one Gift Aid form for St Anne’s to cover gifts to the General and restricted funds.